Our force for good: ESG and SFDR advisory services

Best practice advice on developing and crafting strong sales and marketing communications out of your sustainability products

Our force for good: ESG and SFDR advisory services

Best practice advice on developing and crafting strong sales and marketing communications out of your sustainability products

“The ultimate goal for every fund manager these days is to establish a holistic sustainable investment strategy by integrating sustainability goals into investment, addressing EU taxonomy and SFDR regulations, developing effective scenario analysis, and understanding how to push towards net zero.

Since its inception, DCPLA has been actively engaged in the marketing implementation of sustainable investment strategies for several years now and have been advising foremost real asset managers how to best craft these messages in their fund products marketing and sales pitchbooks to meet the demand of institutional investors of scale across Europe.”

“The ultimate goal for every fund manager these days is to establish a holistic sustainable investment strategy by integrating sustainability goals into investment, addressing EU taxonomy and SFDR regulations, developing effective scenario analysis, and understanding how to push towards net zero.

Since its inception, DCPLA have been actively engaged in the marketing implementation of sustainable investment strategies for several years now and have been advising foremost real asset managers how to best craft these messages in their fund products marketing and sales pitchbooks to meet the demand of institutional investors of scale across Europe.”

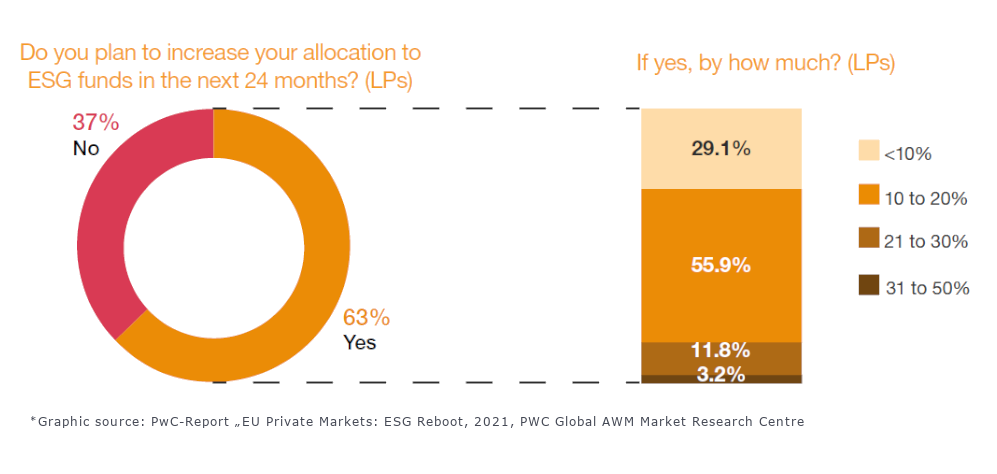

Strong uptake in demand for ESG funds in the next 24 months (Oct 2021- Oct 2023)

- In the recent report PwC-Report "EU Private Markets: ESG Reboot, 2021", it has been revealed that there is strong expected demand for sustainable investments to intensify as sustainability considerations become increasingly anchored within global corporate governance and as investors become increasingly aware of the key opportunities that stand to be unlocked.

Our track record with strong sustainability investment product providers

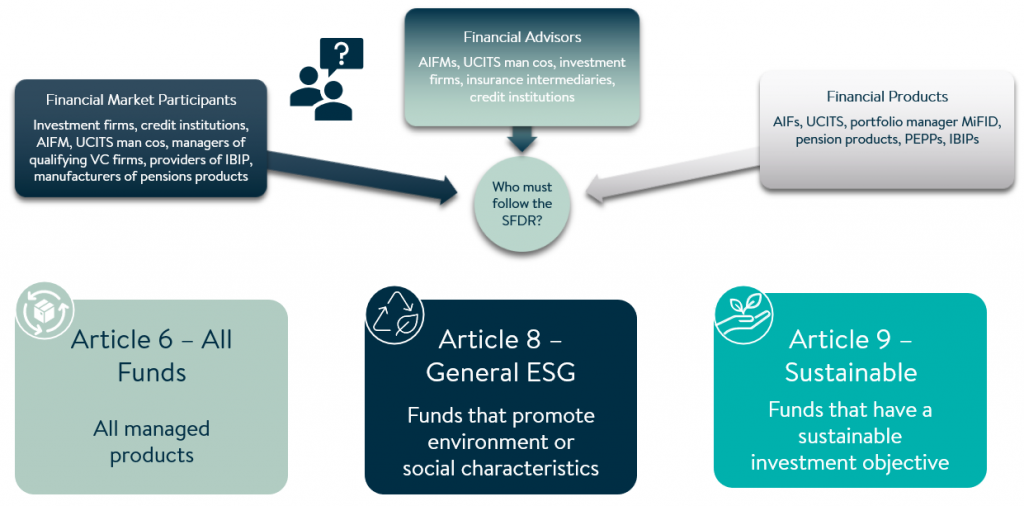

The Sustainable Finance Disclosure Regulation (SFDR) of the European Union came into force on March 10, 2021 in order to create transparency with regards to the inclusion of sustainability risks in the investment process and the consideration of adverse effects on sustainability factors in financial investment products.

What is SFDR?

- The Sustainable Finance Disclosure Regulation (SFDR) imposes mandatory ESG disclosure obligations for asset managers and other financial markets participants with substantive provisions of the regulation effective from 10 March 2021. The SFDR was introduced by the European Commission alongside the Taxonomy Regulation and the Low Carbon Benchmarks Regulation as part of a package of legislative measures arising from the European Commission’s Action Plan on Sustainable Finance.

EU’s Sustainable Finance Disclosure Regulation (“SFDR”)

Source: Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector.

The SFDR aims to bring a level playing field for financial market participants (“FMP”) and financial advisers on transparency in relation to sustainability risks, the consideration of adverse sustainability impacts in their investment processes and the provision of sustainability related information with respect to financial products. The SFDR requires asset managers such as AIFMs and UCITS managers to provide prescript and standardised disclosures on how ESG factors are integrated at both an entity and product level. A significant portion of the SFDR applies to all asset managers, whether or not they have an express ESG or sustainability focus. *

*KPMG, SFDR – a Snapshot, March 2021

Functional Always active

Preferences

Statistics

Marketing

Read about how we use cookies and how you can control them here. Continued use of this site indicates that you accept this policy.