Our Competitive Edge in a MIFID and Post-Brexit Environment

DCPLA managed to meet all regulatory requirements of the new AIFMD Regime and fully qualifies as a Placement Agent for Pan-European mandates & the UK post-Brexit

Our Competitive Edge in a MIFID and Post-Brexit Environment

DCPLA managed to meet all regulatory requirements of the new AIFMD Regime and fully qualifies as a Placement Agent for Pan-European mandates & the UK post-Brexit

With this certification, we surpass 90% of our peers and

give 100% regulatory confidence to our GP clients.

Deep Track Record

- Pan-European institutional sales team: In-house native speakers and relationships to cater all the top markets in the European Union.

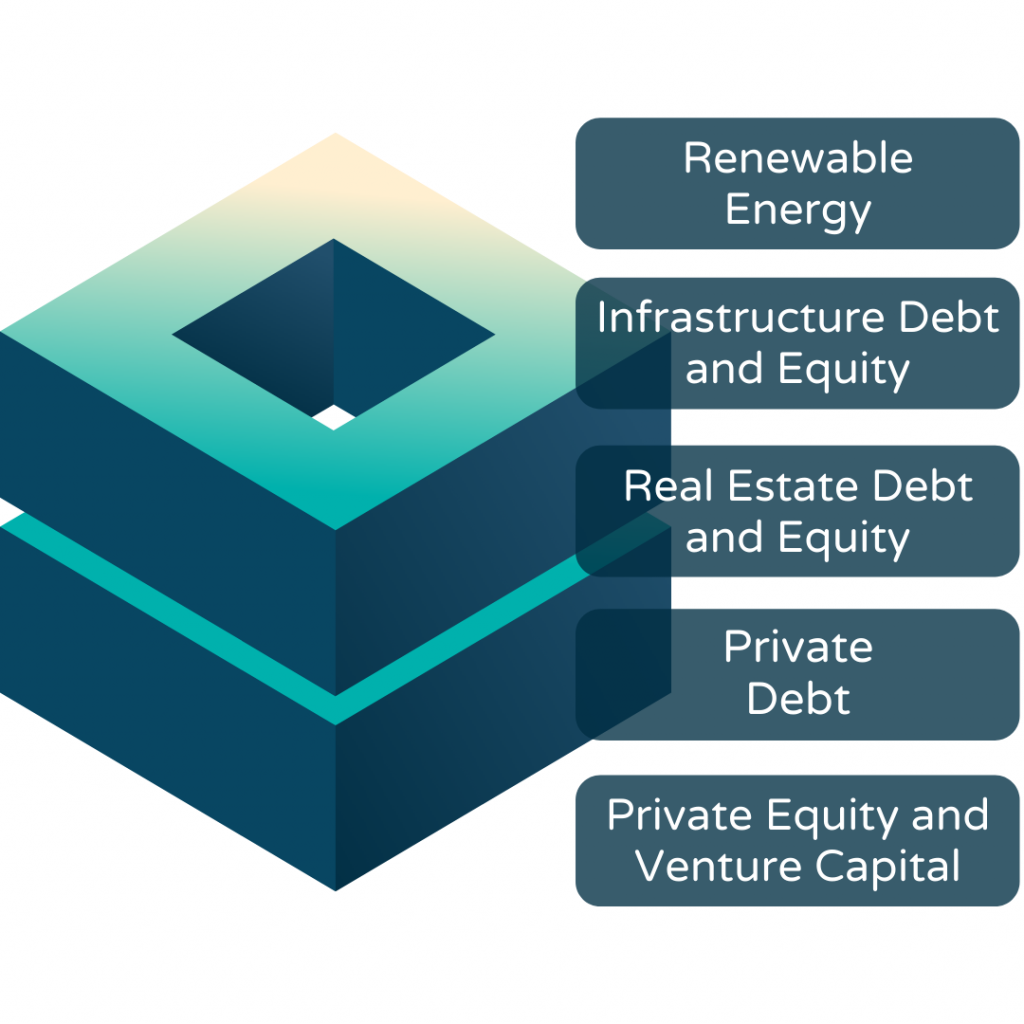

- Focused approach: DCPLA focuses on alternative investment funds only, such as infrastructure & renewable energy, real estate, private debt, and PE&VC. Strong track record in infrastructure fundraising (equity and debt).

- Pan-European fundraising: Successfully raised funds from various European countries for various asset classes.

100% Compliant

- After Brexit, UK (London) is regulatory wise strictly out as the hub for EU wide fundraising. UK is after Brexit no more part of AIFMD regime and UK regulated placement agents cannot continue 3rd party marketing for asset managers in EU.

- From August 1st, 2021 onwards new regulation will be effective and pre marketing will be then regulated: For fundraising purposes the asset manager has to have an own MIFID license in place or alternatively has to work with a regulated placement agent.

- DCPLA is compliant in the European Union: DCPLA in EU is a fully regulated financial services provider and 100% compliant with the EU laws. Plus, we qualify to sell to UK investors.

- With this license we beat 90%* of our peers and give 100% confidence to our GP clients.

*Most of our peers are located in the UK and only 10% meet the rigid requirements of MIFID. See placement agent list in Preqin as of June 2021.

German Footprint

- German-speaking Europe, i.e. DACH, is the largest institutional market in Europe after Brexit with close to 1,000 institutional investors speaking one common language, German.

- Independent: Founded in 2008 in Munich, Germany, DC Placement Advisors is 100% privately owned and independent European placement agent.

- In-house native speakers: 4 in-house German natives in the institutional sales team.

- Proprietary German Edge: 13yrs of experience with complex German investment ordinance, the opaque investment landscape, tax code & access to top notch German lawyers & tax advisors ensure your smooth fundraising.

Manage Cookie Consent

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Functional Always active

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

Preferences

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

Statistics

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

Marketing

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.

DC Placement Advisors uses cookies to deliver superior functionality and to enhance your experience of our websites.

Read about how we use cookies and how you can control them here. Continued use of this site indicates that you accept this policy.

Read about how we use cookies and how you can control them here. Continued use of this site indicates that you accept this policy.